We live in a world defined by tradeoffs. No one gets fit without working out. Historically, in crypto, system designers have been forced to choose between secure and fast. Efforts have been made to expand the frontier but these usually add complexity or cost (more nodes for e.g.)

We believe that Optimistic Escrow is a paradigm shift within DeFi, meaningfully expanding the tradeoff curve by applying lessons from L2 development to DeFi.

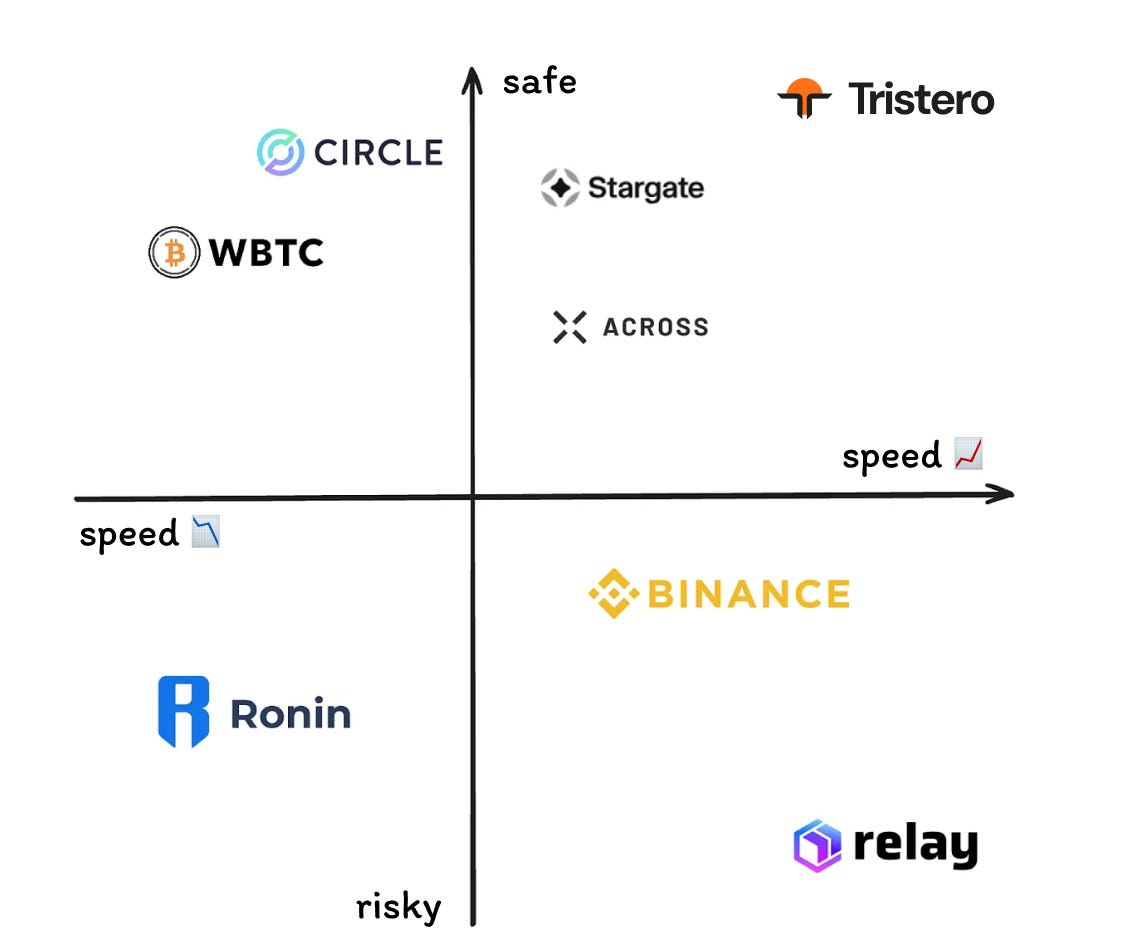

The current tradeoff curve of “bridges” (cross-chain swaps) can be visualized like this:

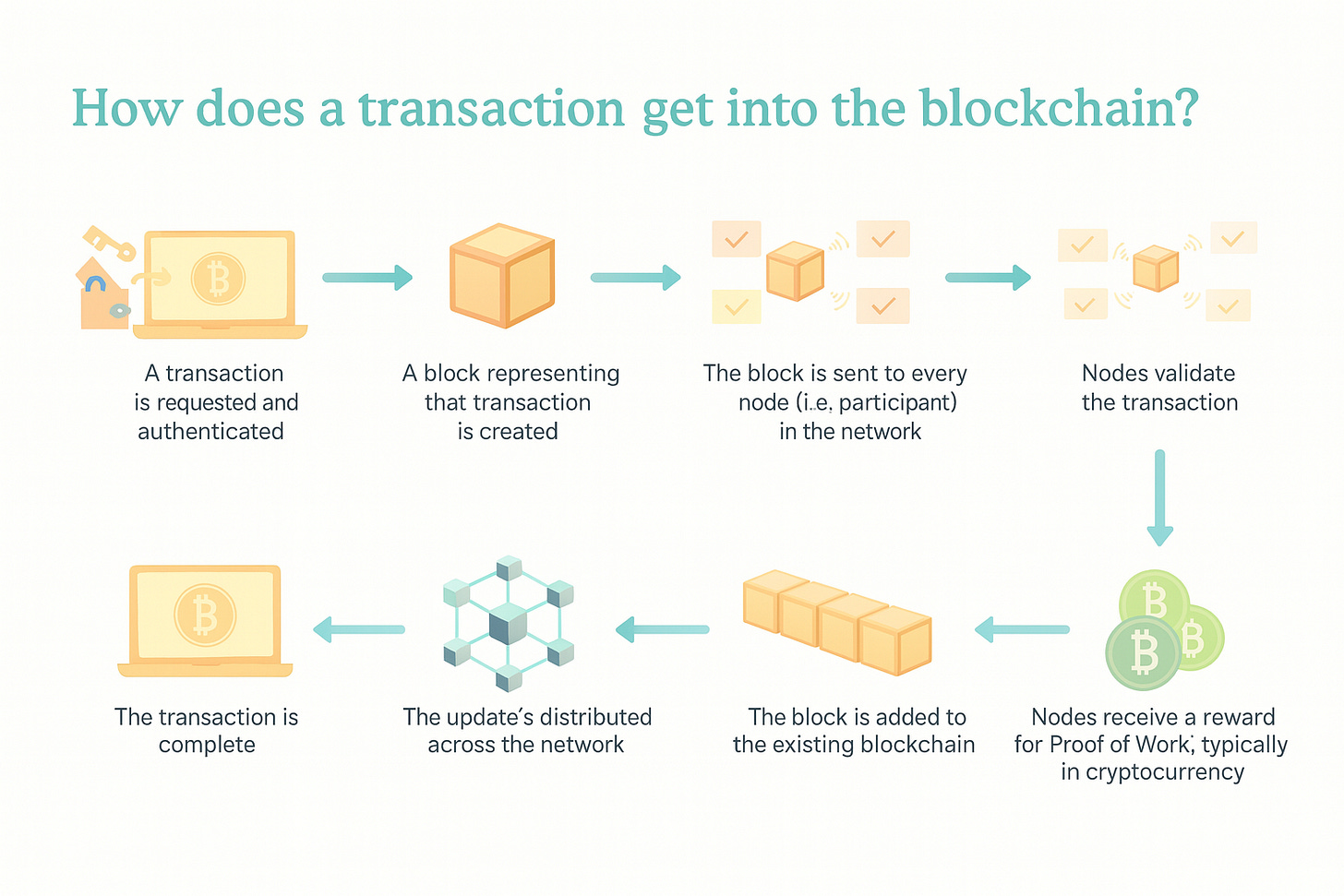

In decentralized finance, security is paramount. To prevent double-spending and ensure the integrity of the ledger, every transaction must be validated, included in a block, and confirmed by a network of decentralized nodes.

This process, known as consensus, is DeFi’s greatest strength, but it’s also the source of its biggest performance bottleneck. For a cross-chain swap, this problem is squared. You must wait for finality on the source chain, transmit a message, and then wait for inclusion on the destination chain.

This “security at the cost of speed” is why a simple swap on a DEX can feel sluggish and expensive compared to the instant execution on a centralized exchange (CEX) like Binance. CEXs achieve speed and highly efficient cross-chain swaps by running on private, off-chain databases, where they usually simply update their internal ledger any time you make a swap (given that most users don’t immediately withdraw funds), but this requires you to trust them completely with your funds. This forces users into a frustrating dilemma: trade at the speed of Wall Street but give up self-custody, or retain control of your assets but accept a slow and cumbersome user experience.

Tristero is engineered to dismantle this false dichotomy. We believe speed and security are not mutually exclusive. The engine powering our vision is a protocol named Optimistic Escrow, which leverages a principle of deferred finality to deliver the performance of a CEX on a secure, decentralized foundation.

A New Paradigm: Assume Honesty, Enforce Accountability

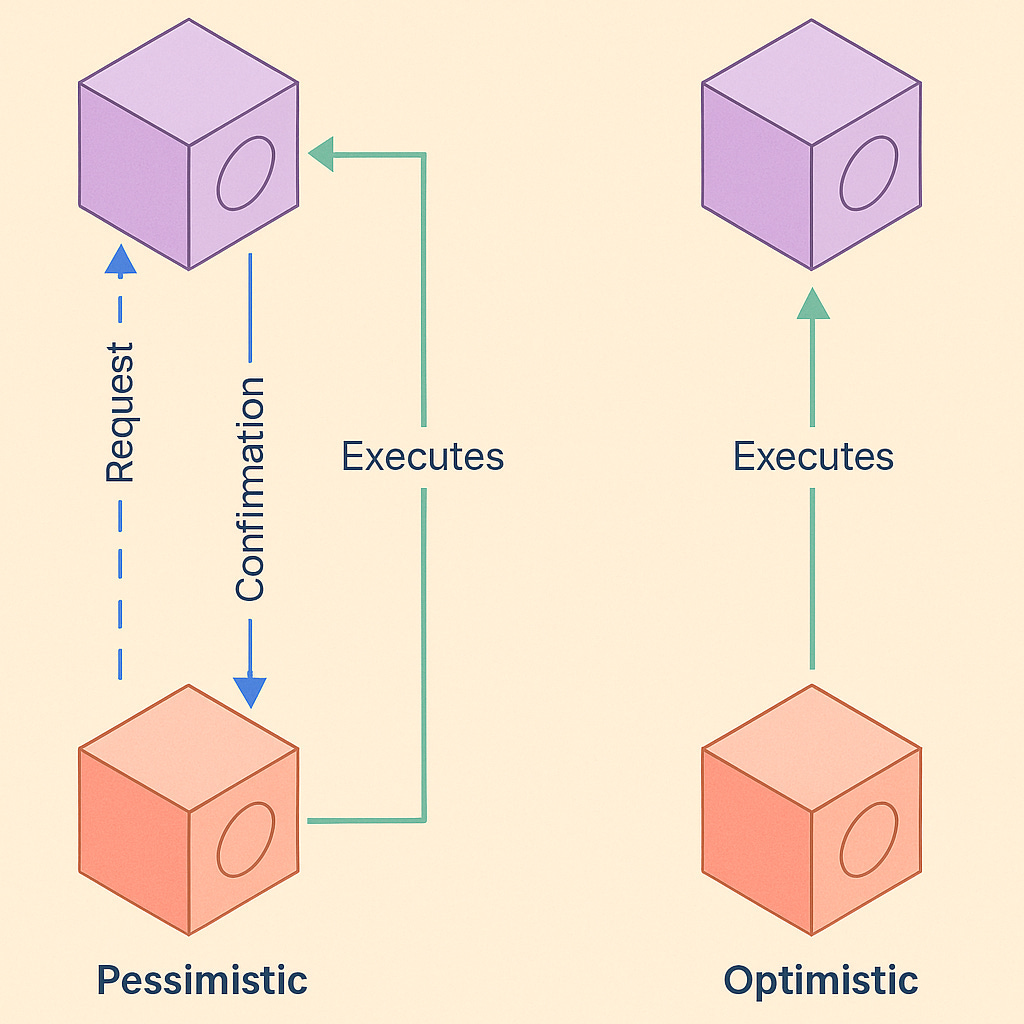

At its core, Optimistic Escrow operates on a “pay now, verify later” model. Instead of forcing a user to wait for cumbersome cross-chain verification to complete, it flips the process around.

The system is optimistic: it assumes the transaction will be completed honestly and pays the user immediately. The final, true settlement for the liquidity provider is deferred, or delayed, until after a brief verification window has passed.

Think of it as a commercial bank check. When you deposit a check, the bank often makes the funds available in your account immediately. They are acting optimistically. They retain the right to reverse the transaction a few days later if the check bounces, but they prioritize your user experience first. Optimistic Escrow applies this logic to the world of crypto, but replaces the bank’s trust with cryptographic and economic guarantees.

The Protocol in Motion: A Technical Walkthrough

Let’s walk through a swap from 10 ETH on Arbitrum to USDC on Polygon to see how this works in practice.

1. The Post: A Gasless, Off-Chain Order

At T+0s, you decide to make the trade. Instead of submitting a transaction directly on-chain, you sign a structured data message off-chain using a standard like Permit2. This signature is a gasless authorization that grants the Tristero smart contract permission to move your 10 ETH at a later time. The message contains all the critical details of your intent: the source and destination chains, the tokens, the amount to be swapped (10 ETH), and the minimum amount you must receive (~30,000 USDC). This signed order is sent to our system without being exposed to the public mempool.

2. The Pay: Instant User Gratification

At approximately T+10s, a liquidity provider—a “filler”—accepts your order. They immediately execute a transaction on the destination chain (Polygon), transferring at least 30,000 USDC directly to your wallet. From your perspective, the swap is complete. You’ve received your funds with the speed and finality of the destination chain itself.

3. The Pull & Lock: The Escrow is Formalized

Simultaneously, at around T+3s, the filler calls the create_match function on the source chain (Arbitrum). This function performs two atomic operations:

It uses your Permit2 signature to pull your 10 ETH from your wallet and lock it inside the Optimistic Escrow smart contract.

It records the immutable hash of your entire order object on-chain, creating a definitive record of the deal’s terms for later verification.

At this point, you have your USDC, and your original ETH is securely held in escrow. The final piece of the puzzle—releasing that ETH to the filler—can only happen after the challenge window closes.

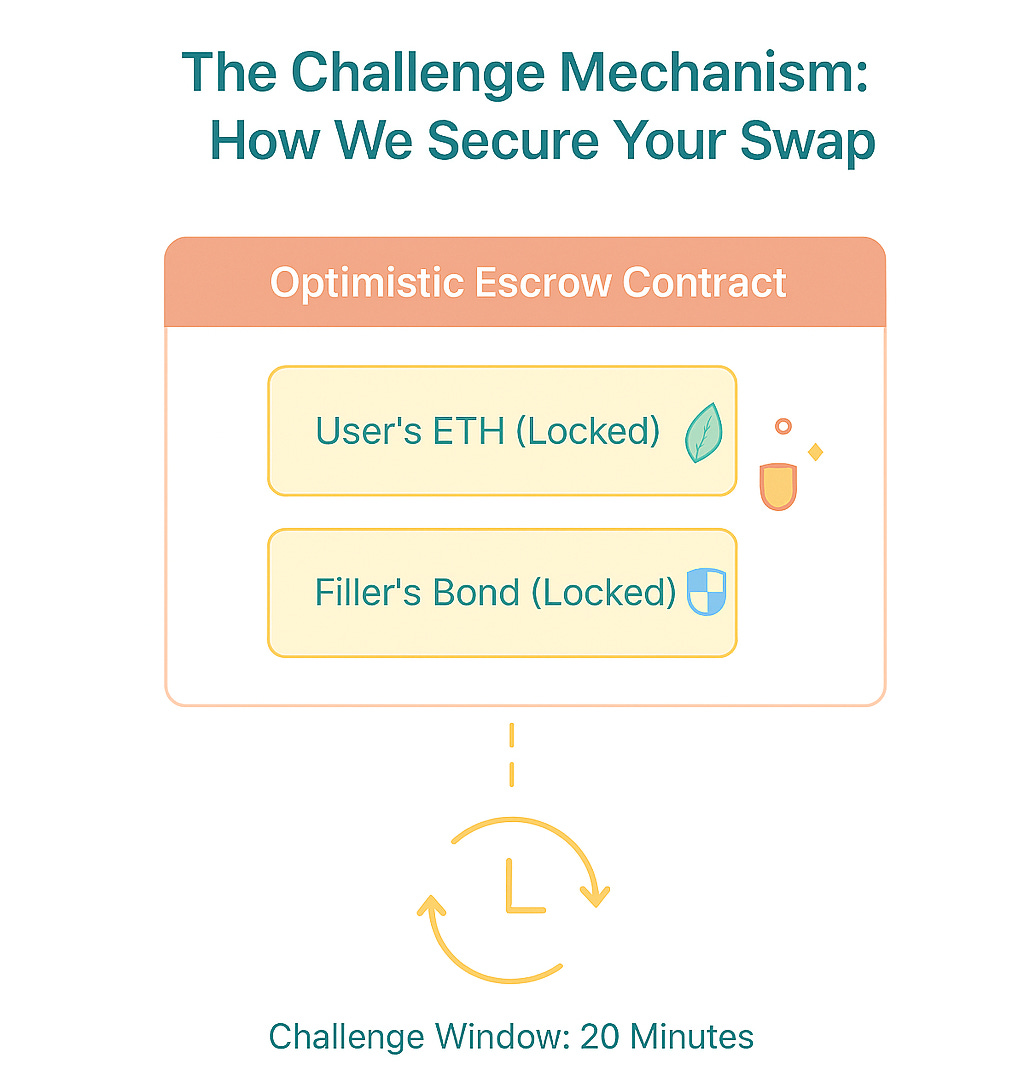

The Ironclad Guarantee: The Challenge Mechanism

The speed of the system is made safe by its robust challenge mechanism. Users don’t need to trust the filler—in this system dishonesty is economically irrational.

After you are paid, a predefined challenge window (e.g., 20 minutes) opens on the source chain. This window provides ample time for anyone to verify the transaction and flag foul play.

Economic Stakes: To even participate, the filler must post a significant financial bond. This bond is locked in the escrow contract alongside your ETH, acting as collateral against misbehavior.

Permissionless Challenge: If a filler fails to deliver the promised funds, anyone can submit a challenge to the source chain contract by referencing the unique Match ID.

Deterministic, Cross-Chain Verification: The challenge triggers a cross-chain message (using a protocol like LayerZero) to the destination chain. This message carries the order parameters recorded on-chain (your wallet address, the minimum amount, the token). The destination contract then performs a simple, deterministic check: it looks at its own on-chain history to see if an ERC20 transfer receipt exists that meets the criteria. There is no subjective oracle or committee; the proof is in the immutable ledger.

Resolution and Incentives:

If the trade was honest: The challenge fails, and the filler is made whole after the window closes.

If the filler cheated: The challenge succeeds. The escrowed 10 ETH is returned to you. The filler’s bond is slashed; a portion is awarded to the challenger as a bounty for securing the network, and the rest is captured by the protocol.

This explicit, economically-driven process creates a powerful incentive for third-party watchers to monitor the network, ensuring its integrity without a central authority.

The Result: Performance Unlocked

This architecture makes Tristero secure, fast, and cheap while remaining decentralized. Your perceived wait time is completely decoupled from the slower, more complex process of cross-chain final settlement. You only wait for a single block confirmation on the destination chain to receive your funds.

Optimistic Escrow elegantly solves the speed vs risk tradeoff any bridge must face. It delivers the instant execution users demand, backed by the trust-minimized, self-custodial security that is the entire point of DeFi. By mastering this complex interplay of off-chain signatures, on-chain escrow, and economically-incentivized challenges, we have built a foundation for a truly performant and secure financial future.

Have you looked into hedera.com ? It's seems even faster and secure. And VERY low cost.